Please select your default language.

Select Language

Investment Banking

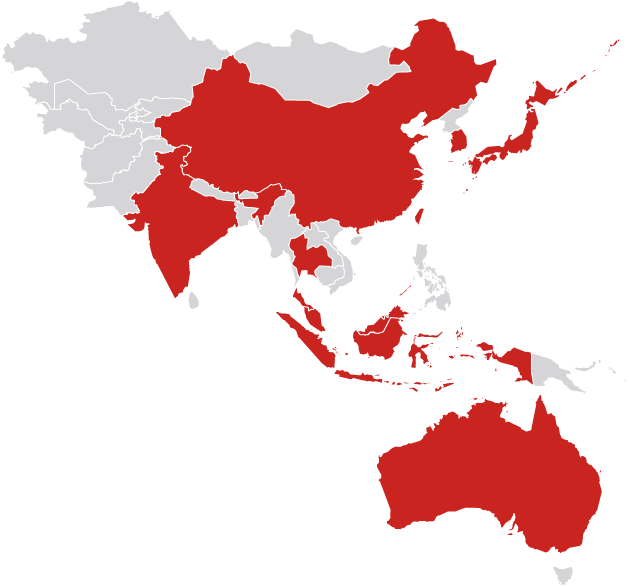

We provide advisory and capital-raising solutions to corporations, financial institutions, private equity, governments, sovereign wealth funds and public-sector organizations – not only in Japan, but around the world. Ours is a truly joined-up platform, built out over the years with our clients at the forefront. Collaborating across geographies, industries and products, we provide comprehensive and innovative financing, advisory and risk management solutions. With our long and proven track record of building financial markets in Asia coupled with deep experience in growth markets, we are in a unique position to deliver the fastest growing region to issuers and borrowers alike.

Our Products

- Debt Capital Markets

-

We originate and execute debt and debt-related transactions e.g. Bonds and Structured Notes with teams focused on Financial Institution clients (DCM FIG), as well as Corporates (DCM Corp), Public Sector Agencies and Sovereigns (DCM SSA).

- Equity Capital Markets

-

ECM Cash / Equity Linked

We originate and execute equity and equity-related transactions e.g. Initial Public Offerings, Rights Issues, ABB and Convertibles.

Corporate Equity Derivatives

We provide equity derivative solutions to clients such as Corporates and High Net Worth Individuals. These include derivatives that hedge market risk and to monetize or build equity stakes and to raise finance.

- Acquisition and Leveraged Finance

-

We arrange financing for leveraged buyouts (LBOs), corporate acquisitions along with on-going refinancing needs using a variety of debt products (such as leveraged loans, mezzanine loans and high yield bonds).

- Risk Solutions

-

A solutions-driven team, RSG are an integral part of Investment Banking, applying a broad range of Fixed Income solutions to address specific financial and non-financial risks faced by clients. This encompasses both event driven solutions (e.g. deal contingent hedging) and non-event driven solutions (e.g. interest rate and cash management, liability benchmarking and currency management problems).

- Insurance Solutions

-

We are dedicated to understanding the specific capital and risk management needs of insurance companies and developing cutting-edge solutions to help them respond to these challenges. These include securitization products, structured reinsurance and derivative hedging solutions for complex insurance-specific asset and liability risks.

- Global Finance Solutions

-

We focus on advising on, and developing, bespoke capital and risk management solutions to help clients manage their capital needs and balance sheet risks more effectively.

- Mergers & Acquisitions

-

We act as a financial advisor to identify and facilitate strategic merger and acquisition opportunities or sale of business opportunities for our corporate, financial institution and sponsor clients.

Geographies

Industries

Consumer / Retail

Industrials

Healthcare

Natural Resources & Power

Telco / Media / Technology

Financial Institutions

Business Services

Real Estate / Gaming / Lodging / Leisure

FINANCIAL SPONSORS

Awards

Click here for our recent awards.