Please select your default language.

Select Language

Nomura Group

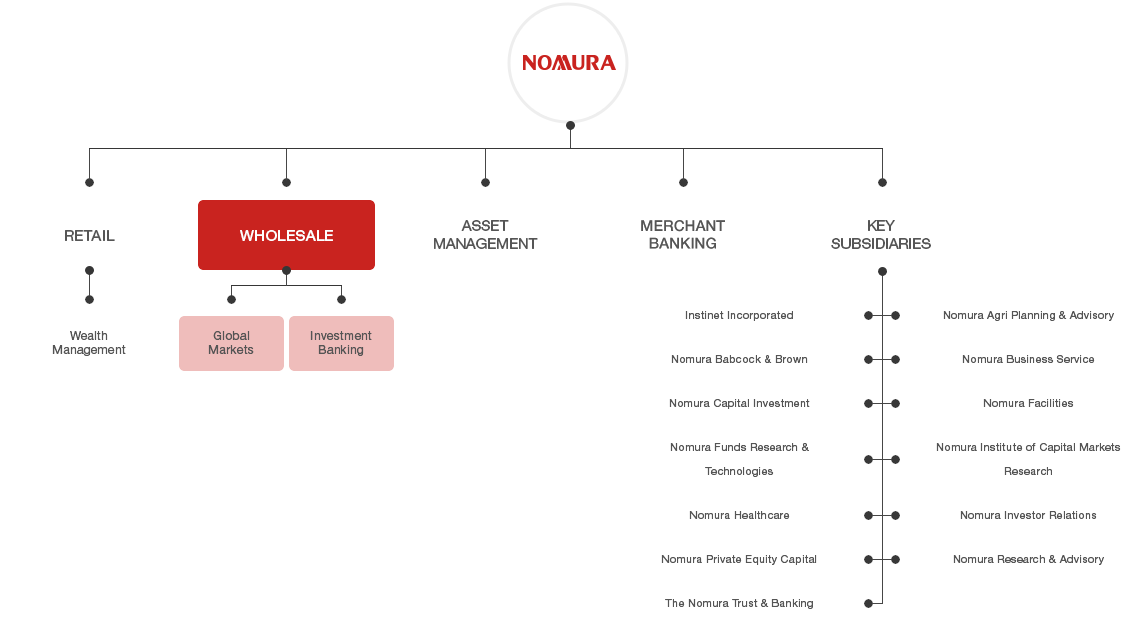

Nomura Group is a financial services group comprising Nomura Holdings, Inc. and its subsidiaries in Japan and overseas. Nomura Holdings has controlling stakes in companies that conduct investment and financial services business with an emphasis on securities.

Our structure

Key quarterly financials *1

As of December 31, 2025

Issuer Credit Rating:

Fitch: A- | Moody’s: Baa1 | Standard & Poor’s: BBB+

Note: US dollar amounts translated at the rate of Y156.80 = 1USD, the Federal Reserve rate on December 31, 2025

Our Global Network

As of December 31, 2025

Americas

3,030

Our Wholesale operation services local clients through nine locations in the United States, which represents the largest fee pool in global investment banking. Nomura also operates a boutique investment management firm specializing in high-yield investments.

EMEA

3,237

Headquartered in London with operations in 17 countries, our EMEA business has over 50 years of experience connecting markets East and West. We provide a wide range of solutions across Global Markets and Investment Banking to our corporate, institutional, government and public sector clients.

Asia ex-Japan

7,273

Building on the presence we have established across 15 cities, we are laying the foundation to further expand our retail, wealth management and asset management capabilities in the Asia region where we see long-term economic growth.

Japan

15,061

In addition to managing 118 trillion retail client assets and 22% of securities accounts in Japan, we are the country’s largest asset manager by assets under management. We also provide a broad range of sales and trading as well as underwriting and advisory services to our clients in Wholesale.